Music. Hi guys and welcome back to my channel. So, I recently made a change to one of our bills, and I thought I would walk you guys through the process behind making that change. I will also talk about how you can make the change if you need to. If you're interested in hearing about that, then please keep watching. Okay, so before we talk about the changes that I made, let's talk about what our month looks like. I am predominantly a pen and paper budgeter, so that's why we are looking at this instead of a computer screen or an Excel worksheet or whatever the case is. First of all, let's talk about these paydays. We're gonna hit those first, and I want to point, so let me find me a pointer. This payday is my payday. It is actually a variable payday, meaning it changes from month to month. It is also not guaranteed that it's going to come here. It is supposed to come the first week of every month, and typically it's supposed to come like the first Thursday of every month. But I've gotten it as late as the third week, so I don't really rely on this too much. In fact, I don't really rely on it at all. I don't expect for it to come here. So, therefore, I do put it on here as that day, but I don't really expect for it to come. With that being said, our first full payday for the month of October will be this day here. That is essentially a fixed amount. It doesn't change much. It might change a little bit, but not too much. We can pretty much always figure out or know the amount that is going to be or around...

Award-winning PDF software

Payroll tax due dates Form: What You Should Know

For more information, go to Social Security, Medicare, or IRS. How to Avoid Overpayment — 2018 Annual Reports I need an annual report, such as the one I received for 2017, to help my client plan future cash payments. See my post, What to Expect When You Earn Income, for a good read on what to expect when you receive an income tax return. For more information, see What to Expect when You Earn Income, an article by the IRS. What I Pay Taxes on in an Annual Report I'll pay this tax year: • Payroll tax on April 1, 2017, for Social Security and Medicare + federal income tax withholding + other payroll tax + state income tax withholding • The federal health care law taxes my 2024 net self-employment income + employer health care contributions. See my article, Self Employment Taxes for the Self-Employed and Self-Employee Tax, for examples of what to expect. For more information, see Your 2024 Self-Employment Taxes, an article by IRS.gov (updated 2018). • Employer business travel tax + tax on net business income from self-employment for the calendar year 2024 and later years, which is now paid in installments. Also, you will need a calendar year 2024 Schedule C or Schedule K, Form 1040. See my article, What to expect when you get a business travel statement, and for How to Prepare a Business Travel Statement. For more information, see Business Travel and the Business Travel Tax, Form 4040, and IRS Publication 941, Form 3929, and IRS Publication 523, Business Travel. What is my self-employment tax? Self-employment tax: Generally, self-employment tax is a tax imposed on an employee to the extent that the employee's earnings and profit from self-employment are included in computing gross compensation, and to the extent other than to pay self-employment tax. See my article, Self-Employment Tax, for more information. For more information on self-employment tax, see IRS Publication 970, Employer's Tax Guide, or Publication 525, Employer's Tax Guide for Small Business, and my blog, What is Self Employment Tax? .

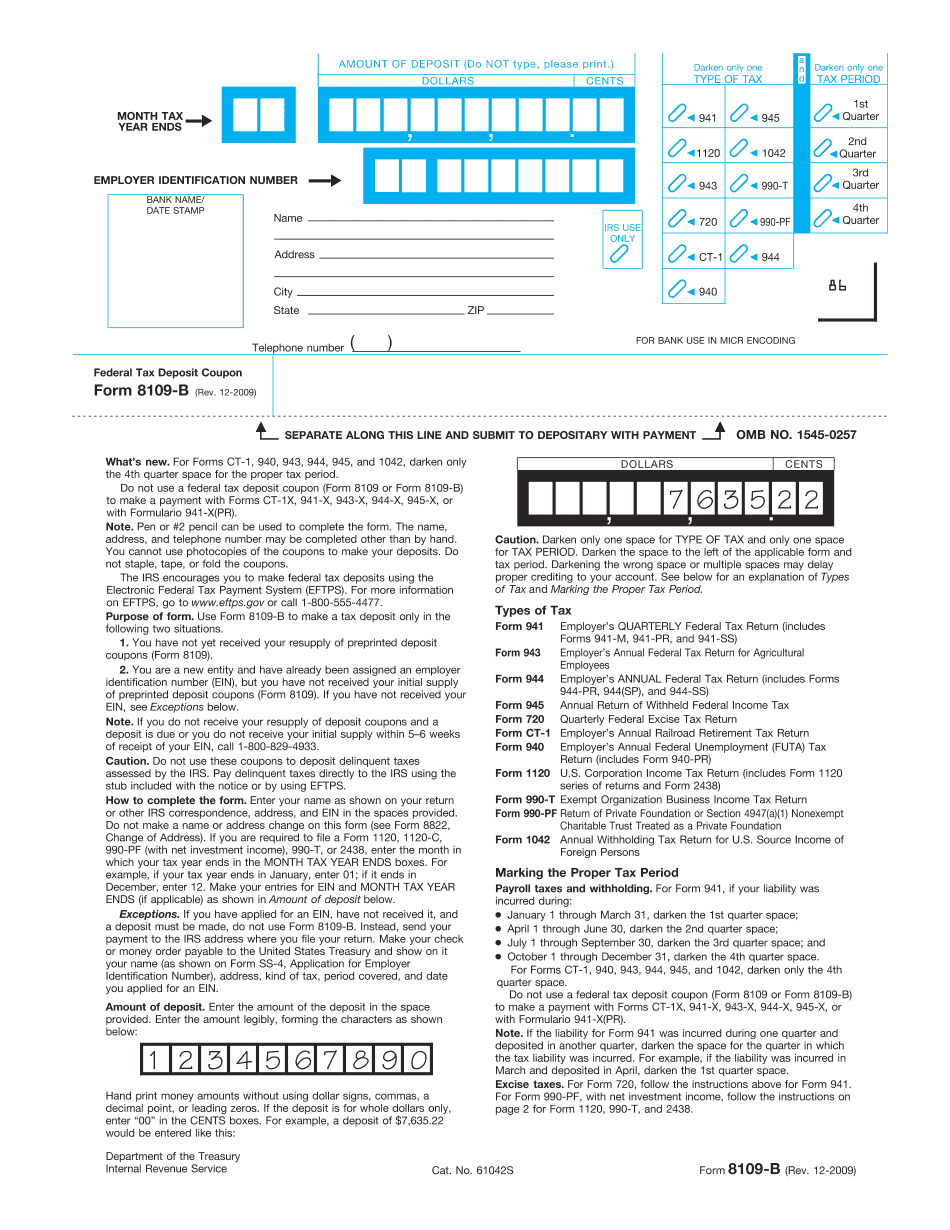

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8109-B, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8109-B online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8109-B by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8109-B from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Payroll tax due dates